Content

To prepare a multi-step income statement, you must first calculate the gross profit by subtracting the cost of goods sold from the revenue. You must then calculate the operating income by subtracting all the expenses from the gross profit. The final figure is the net income, which is calculated by subtracting all non-operating items from the operating income.

Statement users can also make comparisons with other years’ data for the same business and with other businesses. Nonoperating revenues and expenses appear at the bottom of the income statement because they are less significant in assessing the profitability of the business. In a multi step income statement, business activities are separated into operating activities and non-operating activities.

Difference Between Statement of Operation and Statement of Income

An income statement compares company revenue against expenses to determine the net income of the business. Often smaller companies will choose to use a single-step income statement due to its https://www.bookstime.com/articles/multi-step-income-statement ease and simplicity. Going from top to bottom here is how to read your multi step income statement. Each metric will help you make more informed decisions and drive action in your company.

What does the multiple step format of the income statement report?

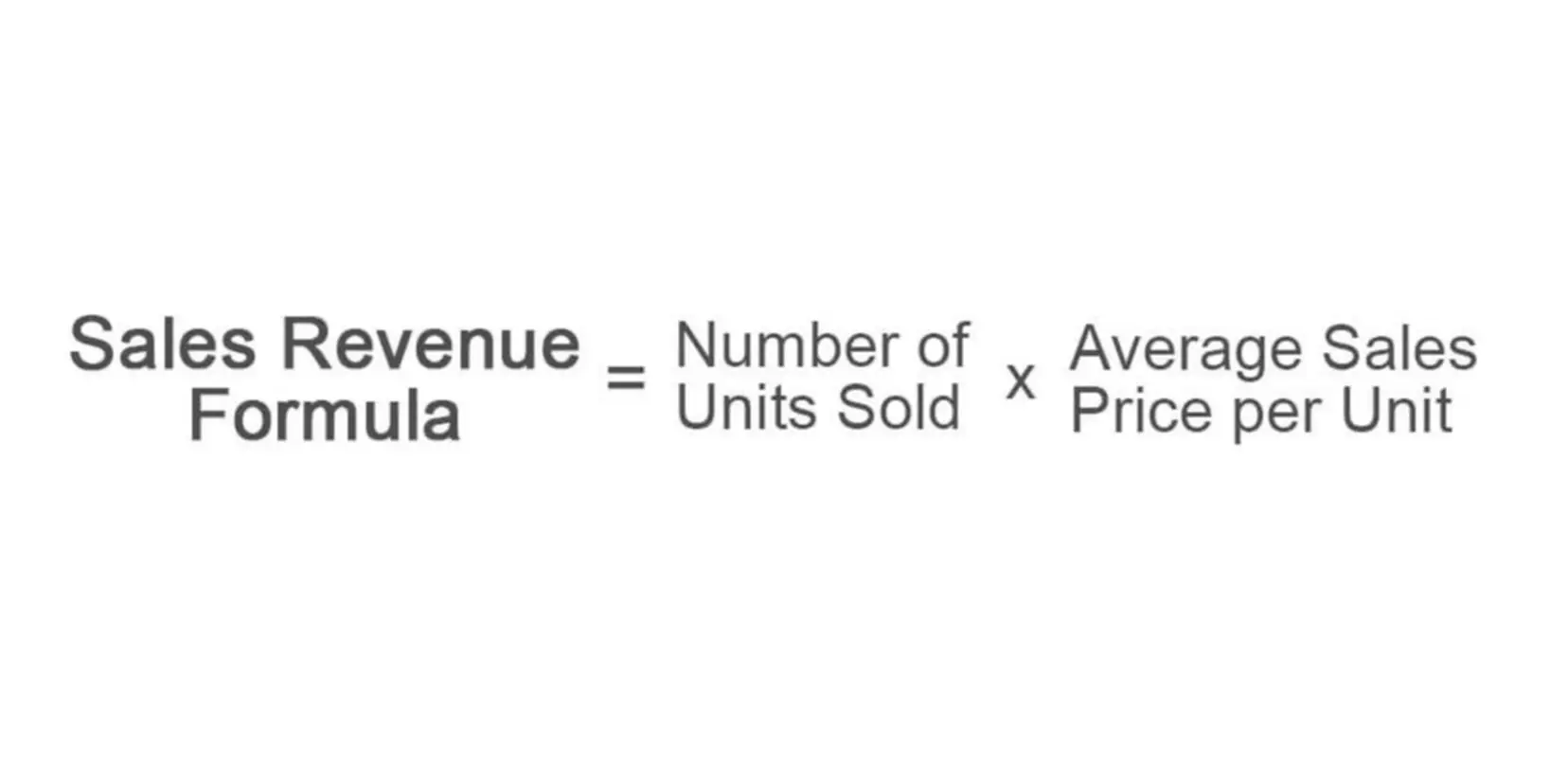

Multi-step income statements use three accounting formulas to calculate a business's net income: Gross profit = Net sales – cost of goods sold (COGS) Operating income = Gross profit – operating expenses. Net income = Operating income + non-operating income.

Notice that net income is the bottom line but it includes a provision for income taxes and also interest expense. On the other hand, a multi-step income statement follows a three-step process to calculate the net income, and it segregates operating incomes and expenses from https://www.bookstime.com/ the non-operating incomes. It separates revenues and expenses from activities that are directly related to the business operations from activities that are not directly tied to the operations. Before you prepare your income statement, you need to select a reporting period.

Multi-step Income Statement

The single-step income statement is the easiest income statement format to prepare, focusing mainly on net income. A Multi-Step Income Statement can be defined as an income statement that breaks down the steps required to calculate net income. If your business is looking to apply for a loan or attract new investment, a multi-step income statement is the best option as it provides investors and creditors with greater financial detail about your business.

In this case, a reader might draw incorrect conclusions from the altered presentation of information. Consequently, when such a change is made, the nature of the change should be described in the footnotes that accompany the financial statements. The multi-step income statement includes multiple subtotals within the income statement. This layout makes it easier for readers to aggregate selected types of information within the report, especially in regard to the core operations of a business. In short, this approach makes it easier to understand the financial results of a business. A multi-step income statement is an income statement that segregates total revenue and expenses into operating and non-operating heads.

The Four Primary Financial Statements That Companies Use

Operating expenses are costs that are incurred to support the company’s regular operations. A multi-step income statement also differs from an income statement in the way that it calculates net income. A single-step income statement includes just one calculation to arrive at net income.

The total operating expenses are a combination of both selling and admin expenses. These total expenses can then be subtracted from gross profit to arrive at the operating income. As an example, let’s suppose a clothing manufacturing company has an overall net profit for a year.

Step 7. Calculate operating income

Companies that are publicly traded, in compliance with GAAP, have strict reporting rules for income statements. They are required to have multi-step income statements for each period, to show whether expenses are ordinary and necessary to the business. This is so governing agencies can have a clear window into what they are doing financially, in the name of public trust. A multi step income statement is a company’s financial statement in a format presenting revenues, costs, and expenses for a specific reporting period.

Paid Employment, Self-employment and Gig Work in Administrative … – Statistique Canada

Paid Employment, Self-employment and Gig Work in Administrative ….

Posted: Tue, 06 Jun 2023 12:39:20 GMT [source]

Once the non-operating section is totaled, it is subtracted from or added to the income from operations to compute the net income for the period. An insurance payout paid to the company’s account as settlement proceeds for damage or loss of a company’s asset can also be considered non-operating income. It contains all business earnings and costs unrelated to the company’s primary and core activities.